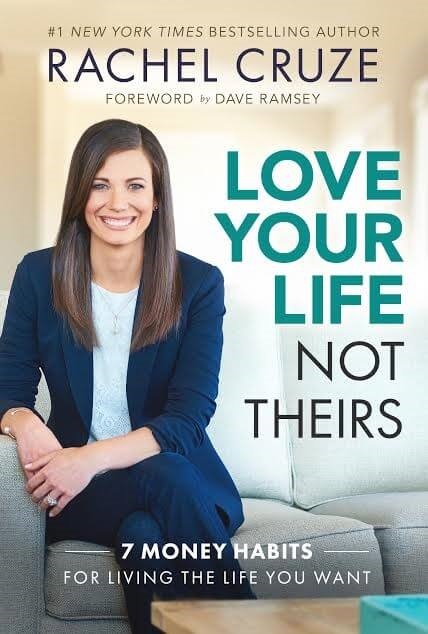

Finance skilled Rachel Cruze shares her vacation spending recommendation for households.

Picture credit score: Cameron Powell

It is probably the most fantastic time of 12 months — as these festive lyrics state — with recollections to cherish endlessly. The vacations are simply across the nook, which implies enjoyable, meals, household…and funds. With regards to vacation spending, it can be a downright irritating time of 12 months.

Monetary skilled and mom Rachel Cruze writer of Stay Your Life Not Theirs, understands how, and why, dad and mom really feel financially burdened round Christmas. The Ramsey Options staff member shares some sensible recommendation on how households can keep away from overspending.

“If you happen to attempt to financially ‘Sustain with the Joneses’ your complete life, you are going to find yourself broke,” says Cruze. “The comparability sport you may by no means win. It you are worried about what others are giving, it’ll steal the enjoyment out of your vacation season, and in addition your paycheck.”

In line with Cruze, daughter of budgeting guru Dave Ramsey, one of the best ways to start saving cash within the new 12 months is to take a look at all of your bills this month — December — and all your wants. “Study all the things it’s important to spend cash on, not together with the vacations, and ensure in spite of everything that’s coated. If there may be any cash left, say, ‘That is the portion we wish to spend on presents.’ Let your monetary scenario dictate your funds, not what everybody’s desires are.”

Use Internet sites like Pinterest to search out concepts for cheap hostess presents. “There are a lot of little, easy trinkets on the market that make nice presents. You possibly can spend $15 on a candle and Williams-Sonoma spatula, and there is your reward to somebody that they’ll, and can, actually use.”

Cruze advises dad and mom to simply be sincere with children about vacation spending if occasions are robust. “Speaking along with your children is essential. Set expectations and say, ‘Hey, our Christmas remains to be going to be enjoyable this 12 months, you are still going to get a present or two,’ however clarify why you do not have the cash to do X, Y, Z and that is what’s greatest for the household — particularly in the event that they’re of the age of understanding.”

“Keep in mind,” says Cruze, “you may get ten presents on the greenback retailer, younger children most likely will not know the distinction, and no, you are not a foul mother or father for doing that. Flip off your cell telephones, and simply spend time along with your children. That is what they’re going to keep in mind.”

Now, in case your youngster has a late December birthday, reward giving can get difficult across the holidays. “Your funds goes to be the identical. If a birthday takes away a bit cash from Christmas, so be it, since you do not wish to take a birthday away from a baby simply because they had been born in December. Your Christmas and birthday funds are going to simply be one.” To make December infants really feel particular, she recommends wrapping some presents in ‘Comfortable Birthday’ paper and others in vacation paper.

This is her recommendation for youths who wish to earn cash: Create a chore chart, and pay your children weekly on the chores they full, as a result of in doing so, there are such a lot of teachable moments. Label three envelopes: Giving, Saving, and Spending

“As soon as children put their cash in every of these envelopes, you are instructing them easy methods to be intentional with the place their cash’s going and that is what budgeting is,” says Cruze. “After they’re doing this with cash they earned themselves, they definitely give, save, and spend otherwise.” In her private weblog, she recollects what her dad and mom taught her and her siblings about incomes: “You’re employed, you receives a commission. You do not work, you aren’t getting paid. Like in the actual world.”

Saving additionally delays prompt gratification. “The debt trade loves prompt gratification: ‘You possibly can have something you need, you simply have to enter debt for it.’ Effectively, saving delays that. It reveals persistence and character-building alternatives, which is one thing I discovered as a child. There’s a lot knowledge and life classes in saving. Youngsters will really feel that possession satisfaction and care for issues higher after they saved up for it. Saving teaches youngsters duty, which they carry into maturity.”

Cruze recommends her dad’s e book collection Junior’s Adventures, which explains to children the worth of cash. “I wish to train my children to be other-centered, versus self-centered, and it may well start with cash,” says Cruze, who has a younger daughter. “I do consider selfless individuals prosper and have higher high quality relationships and a greater high quality of life.”

Moreover, she advises households on New 12 months’s Day, regardless of the place you might be financially, “to do a funds, on paper, your laptop, or your telephone. It’s good to see the numbers visually. Your objective is to take your revenue for January, minus all of your bills, and have it equal zero.” So, each greenback that is coming in in January is designated to a class.

Now, inside that funds, put “Giving” on the high, “Saving” second, after which “Bills,” reminiscent of your payments and meals, hire, mortgage. That is the plan you reside by. “It will be robust, particularly if that is your first time doing a written funds like this. It might take you about three months to get the dangle of it.” Notice that it will not be good in January, however actually attempt to persist with that zero-based funds. Adhere to this in January, and February might be simpler, March might be simpler, “and earlier than it, a behavior might be a part of your life,” says Cruze.

Total, Cruze desires households to vary their views on budgeting. “It would not restrict your freedom, it offers you permission to spend cash. Rethink the best way you take a look at your funds; it offers you freedom to spend with out guilt or questioning.”

Picture credit score: Cameron Powell